It’s not uncommon for us to give out our credit card information over the phone, over email and on pretty much any online shopping portal that asks for it. It’s often necessary…but is it secure? Here’s a look at a privacy-focused alternative known as virtual credit cards, a service that promises consumers the kind of control we’ve never had before. Continue reading to understand how do virtual credit cards work.

There are more than a few problems with traditional credit cards, those pieces of plastic we keep in our wallets and purses:

- They can be stolen;

- Opening and closing a credit card account affects your credit score;

- They take weeks to replace;

- They offer no spending controls (i.e. self-imposed limits);

- Etc., etc.

A virtual credit card offers an intriguing solution to each of these problems. First of all, opening and closing new virtual cards doesn’t affect your credit at all. Each card can be opened/closed in seconds, which makes replacing cards unbelievably easy.

Moreover, virtual credit cards function similarly to physical ones, featuring a unique 16-digit card number, a set expiration date, and a CVV code.

But the BIGGEST advantage – at least from my experience – of using virtual cards is control.

Spending Control | Virtual Credit Cards

We’ll get into the details of how you can setup and use virtual credit cards in a moment, but to begin, let’s look at the level of control offered by Privacy.com, a pioneer in the virtual payments space (although there are some great alternatives to Privacy.com that are available).

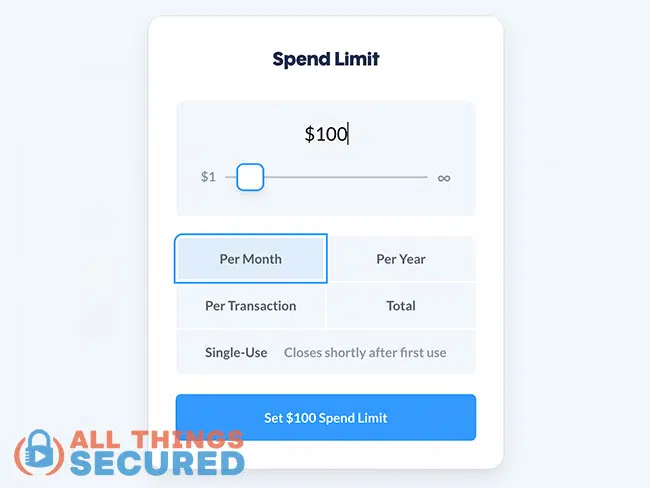

When creating a new virtual card on Privacy, you’re given the option of five different kinds of limits:

- Per month spending limit;

- Per year spending limit;

- Per transaction spending limit;

- Total spending limit;

- One-time use limit; (aka one time use credit card)

It’s important to understand that most virtual cards are not, in fact, credit cards. In most cases, they are glorified debit cards.

Most virtual cards are not, in fact, credit cards. They are glorified debit cards.

While you lose the liability protection of a traditional credit card, you offset that risk by limiting the size of your liability.

Use Case #1: Disney+ (Merchant-Specific Card)

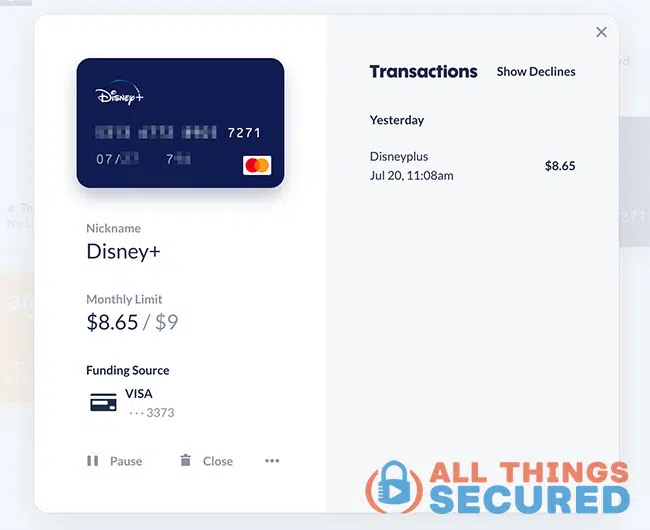

Let’s take Disney+ as an example of how this might work. I know that every month, Disney+ charges me just under $9 per month with taxes.

So I can create a merchant-specific card (a card only used with Disney+) limited to only $9 in monthly charges. Similarly, you can set up many virtual cards for any credit card-accepting merchants like Google Pay and others.

Even if this virtual credit card number were to be stolen, the most the thief could steal would be $9 per month. All other transactions would be declined by the card issuer.

As you can see toward the bottom left of the above screenshot, you also have the control to be able to either “Pause” the credit card or “Close” it permanently.

By creating merchant-specific cards, you not only build better privacy by not giving away your actual credit card number, you also give yourself more control over how these subscription services charge you.

Because if you can’t easily find a “cancel subscription”…

…you can always just close the credit card. 🙂

Opening/Closing Cards in Minutes

Another great advantage of virtual credit cards is the ability to open and close accounts almost instantaneously.

I don’t know about you, but I’ve had my wallet stolen before, and the process of contacting my bank, reversing any fraudulent charges, waiting for a new physical card in the mail and then updating all my online payments for the new card isn’t just frustrating…

…it could take weeks

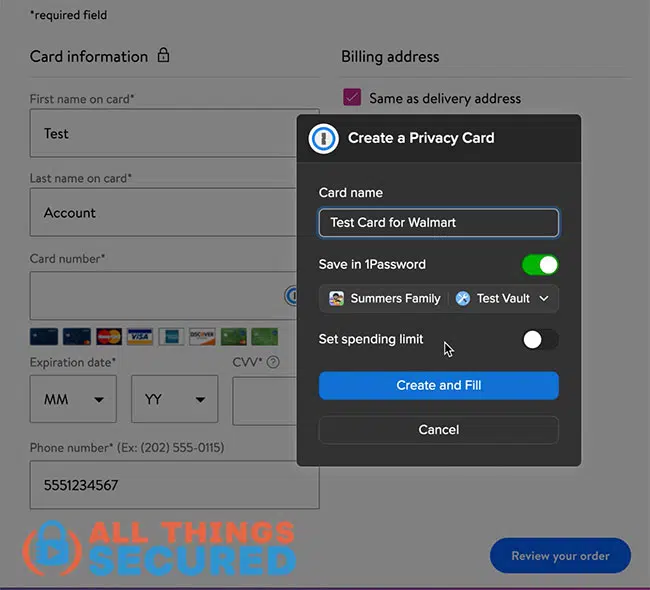

With a virtual credit card, the process literally takes seconds. It’s so fast, in fact, that Privacy.com has integrated with 1Password, my favorite password manager, allowing you to create new virtual credit card numbers automatically as you’re checking out with a merchant online.

Use Case #2: New Walmart Card with 1Password

This cooperation between Privacy.com and 1Password highlights just how easy and fast it is to create a new virtual credit card.

In the example below, while checking out online with Walmart, 1Password allows me to create a Privacy card on the fly:

By clicking “Create and Fill”, the new card number is created, named, saved in 1Password and filled in for Walmart.

I can even set a spend limit to make sure that any future purchases on that card are limited based on the controls outlined earlier (you cannot go back and change these limits, unfortunately…you need to create a new card entirely).

Setting Up Virtual Credit Cards

By this point, you should be able to understand the value of virtual credit cards for your privacy. You’re protecting your real credit card and limiting how much merchants can charge on the cards you give them.

But how easy/hard is it to set up?

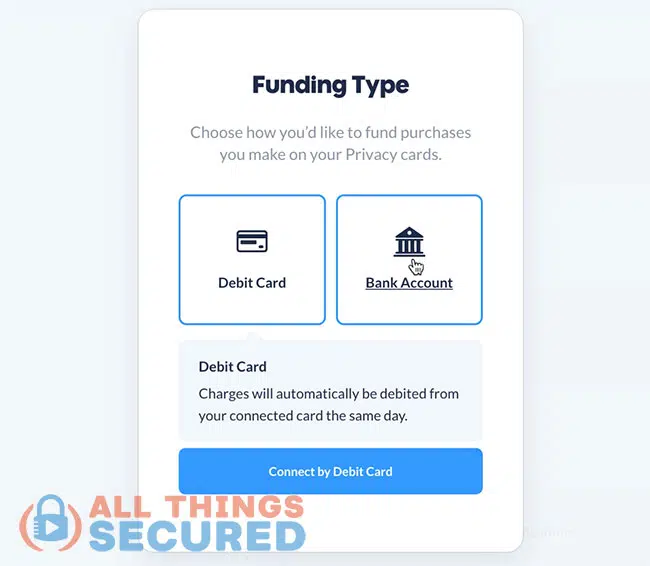

For me, it only took about 10 minutes to get everything set up with Privacy.com. Once I created my credit account, I had to go in and set a “Funding Source”, which was either my debit card or my checking account.

IMPORTANT Note About Funding!

As you can see above, your credit card is not a funding source option with Privacy.com. This means that using Privacy virtual cards limits your ability to earn “miles” or “points” and you must have cash in the bank for all purchases.

Once you’ve set up your funding source, you’re off to the races. You simply start creating cards with virtual credit card numbers and using them for all of your online purchases.

Do Virtual Credit Cards Offer Privacy?

In short, yes, they do. It’s one of many steps you can take to build better online privacy

Virtual credit cards allow you to keep your physical credit card number private and even hide your billing address (Privacy allows you to use whatever billing address you want).

Of equal importance, though, a virtual credit card gives you control over your online purchases.

This is important, especially during those times when you are being asked to share your credit card via email or over the phone.

Use Case #3: Paying Vendors via Email

Just last month, I had a lawn company do some work on one of my rental properties. They sent me the invoice but unfortunately had no online portal that would allow me to pay online. Instead, they told me, I should just email them my credit card information.

Obviously, I didn’t feel comfortable with that.

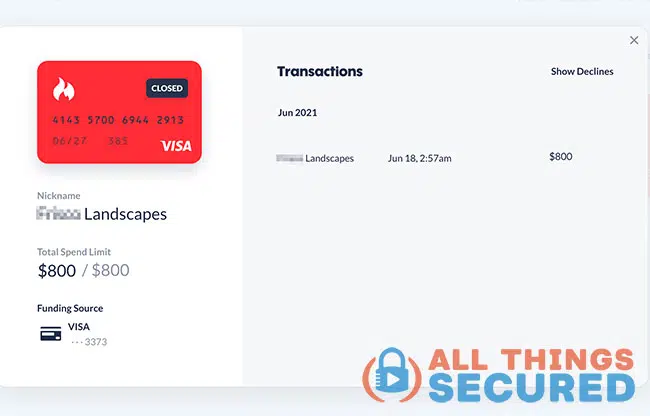

So instead, I created a virtual card for the exact amount of the invoice ($800) and sent them the virtual credit card information.

If they had tried to charge my virtual credit card for anything more than $800, it would have been declined.

I also set it up as a one-time use virtual card, so that once they charged the card for $800 (which they did, as you can see above), the card was automatically cancelled. This was a one-time need for their services, so I didn’t want to keep that card open.

How did this reinforce my privacy?

- I never gave this company my real credit card number;

- I never gave this company my real address;

My privacy was kept intact.

So yes, virtual credit cards seem to be an excellent solution for you to shop online with increased privacy.