When it comes to online safety, many of us have heard the usual advice—use strong passwords, enable two-factor authentication, and consider using a VPN. While these are great strategies, there are lesser-known cybersecurity tips that can significantly improve your security without requiring much effort. In this article, we’ll explore seven cybersecurity tips that are easy to implement but often overlooked.

Each of these cybersecurity tips come with an explanation for why it works and how to set it up. These should take less than 10 minutes to implement, but could save you huge headaches in the future. These include:

- Separate email for financial accounts

- Tap-to-Pay vs Card swipe

- Unique usernames for online logins

- Set up a credit freeze

- Tether to mobile data, not public WiFi

- Turn off WiFi & Bluetooth when not in use

- Protect your Phone from Theft

Let’s dive in!

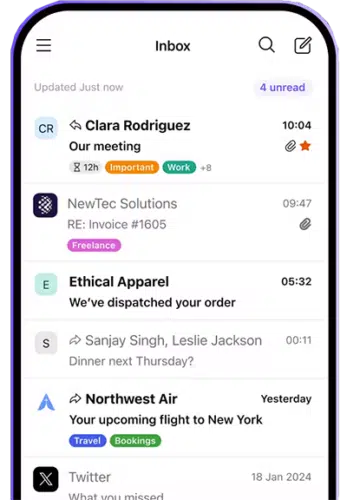

Use a Separate Email for Financial Accounts

Most people use the same email for everything, from shopping to social media to online banking. This can create a huge security risk. If your primary email is ever compromised, it could give hackers access to everything, including your sensitive financial accounts.

Instead, create a separate email address solely for your banking, investments, and other sensitive logins. This makes it harder for phishing campaigns and hackers to target your financial accounts because they won’t know this secret email exists.

BONUS: Start Using Secure Email

Instead of creating a new Gmail or Yahoo account for this separate email, why not take this opportunity to start using a proper secure email alternative? It’s easy to set up and offers multiple benefits. We recommend Proton Mail.

Why This Works:

Phishing scams often rely on sending fake emails to your primary address, tricking you into thinking they’re from your bank or another trusted institution. By using a private, separate email for banking, you’ll immediately know that any suspicious emails sent to your primary inbox aren’t real.

How to Set It Up:

- Create a new email account with a secure provider like ProtonMail or Tuta.

- Update your login information with all your financial institutions.

- Keep this email completely private and only use it for your financial activities.

Use Tap-to-Pay Instead of Swiping Your Card

When you swipe your credit card at a store or enter your card number online, you’re sharing your actual card details with the retailer and their payment processor. If that retailer or processor gets hacked or has poor security measures, your card information could be exposed.

Tap-to-pay, whether through Apple Pay or Google Pay, is a much more secure option.

Instead of sharing your card number, these services generate a unique token that’s used for that transaction only. This means your actual credit card number is never shared with the merchant.

How Tap-to-Pay Works:

- You load your credit card into Apple Pay or Google Pay.

- When you pay at a store, you simply tap your phone or smartwatch.

- A unique, one-time-use token is generated, which ensures your real card number remains safe.

Why This Matters:

If a business gets hacked and customer payment details are leaked, your card information won’t be at risk because it was never shared in the first place.

Create Unique Usernames for Online Accounts

Most of us use the same email or username across multiple accounts, which can be a security risk if that information is leaked. Hackers already have half of the “keys” to your online accounts—the username—and now they just need to crack the password.

Instead, use a unique email or username for each new account you create. This adds an extra layer of security because even if one account is compromised, others won’t be at risk.

Tools to Help:

- Apple’s Hide My Email: For Apple users, this tool creates random, unique email addresses for each new account you sign up for.

- ProtonMail with SimpleLogin: This service allows you to generate unique email aliases for different logins, keeping your real email address private. This is part of any paid ProtonMail account.

Why It’s Effective:

By using different usernames or email addresses for each account, hackers can’t easily use the same credentials across multiple sites if one account is breached.

Set Up a Credit Freeze

A credit freeze is one of the simplest yet most effective ways to protect yourself from identity theft. When your credit is frozen, creditors can’t access your credit report, which makes it almost impossible for anyone to open new credit accounts in your name.

How a Credit Freeze Works:

- When you apply for a credit card or loan, the creditor pulls your credit report.

- If you have a credit freeze in place, they won’t be able to see your report, and the application will be denied.

How to Set It Up:

- Contact the major credit bureaus (Equifax, Experian, and TransUnion) to freeze your credit. Follow this tutorial to set up a credit freeze.

- If you need to apply for credit, you can temporarily lift the freeze (called “thawing”), then re-freeze it once you’re done.

Why You Should Do It:

Even if someone has your personal information, they won’t be able to open new lines of credit without access to your credit report. It’s an extra layer of security that costs nothing and is easy to manage.

Tether to Mobile Data Instead of Using Public Wi-Fi

Public Wi-Fi networks, like those at coffee shops or airports, are a hacker’s playground. They’re often unsecured, making it easy for cybercriminals to intercept your data. While using a VPN can add security, public Wi-Fi is often slow to begin with, and adding a VPN can make it even slower.

A better alternative is to tether your device to your mobile data. This gives you a secure, fast connection without the vulnerabilities of public Wi-Fi.

Why Tethering is Safer:

- Public Wi-Fi networks can be easily compromised, allowing hackers to spy on your online activities.

- Your mobile data connection is private and only accessible through your mobile carrier, offering better protection.

How to Tether:

- On your smartphone, go to your network settings and turn on “Mobile Hotspot.”

- Connect your laptop or other devices to your phone’s data network.

- If you’re still concerned about your mobile carrier, you can connect through a good VPN.

When to Use It:

Whenever you’re in a public place and need to access sensitive information or complete transactions, tethering provides a safer alternative to free Wi-Fi.

Turn Off Wi-Fi and Bluetooth When Not in Use

Most people leave their phone’s Wi-Fi and Bluetooth on all the time, but this creates a potential security risk. Your phone is constantly scanning for networks or devices to connect to, which can expose you to attacks.

Hackers can exploit this by setting up fake Wi-Fi networks or using Bluetooth vulnerabilities to gain access to your device.

Simple Fix:

- Turn off Wi-Fi and Bluetooth when you’re not using them.

- Consider using automation tools like IFTTT to turn these features off when you leave certain locations (like your home or office).

Why This Matters:

By keeping Wi-Fi and Bluetooth off when you don’t need them, you minimize your device’s exposure to potential threats, keeping your data and personal information secure.

Protect Your Phone from Theft

Our smartphones contain vast amounts of personal data, from emails and contacts to banking apps and social media. If your phone is stolen, you could lose more than just the device—you could also expose your private data.

But most people don’t know that our phones offer different types of theft protection as part of the OS.

Easy Steps to Protect Your Phone:

- Backup your phone regularly: Whether you use a cloud service or back up to a computer, having a recent backup ensures you can recover your data if your phone is stolen.

- Enable stolen device protection: On iOS, go to settings and turn on “Stolen Device Protection.” For Android, activate theft detection lock.

Bonus Tip for iPhone Users:

With iOS 18, you’ll be able to force Face ID for specific apps, adding an extra layer of security even if someone has access to your phone. This feature prevents unauthorized access to sensitive apps, ensuring your data remains secure.

Final Thoughts

By implementing these seven easy-to-do cybersecurity tips, you can drastically improve your online safety. Whether it’s using a separate email for banking, setting up a credit freeze, or simply tethering to your mobile data, these strategies offer powerful protection in a world full of cyber threats.