Manually linking your bank account to financial services apps can be a hassle. Conveniently, there are FinTech companies like Plaid that offer a secure connection to your bank account for financial services apps. But is Plaid safe? Should you use them to connect to your financial institution? Here’s what you need to know.

Financial technology has become an integral part of our lives. In fact, if you’ve connected your financial accounts to any other kind of service, chances are you’ve used Plaid.

So, without us knowing it, we most likely have already shared our personal information and financial data with Plaid. So why in the world have they been sued for $58 million? More importantly, is Plaid safe to use?

What is Plaid Financial Data?

Plaid is a financial technology company that acts as a middle man between your bank and any other financial services applications. They offer an important verification service.

What is Plaid bank verification?

Plaid bank verification is the process by which they authorize payments or data from your bank to be transferred to a third party without that third party having direct access to your account information.

So, instead of giving out your bank account information to EVERY application, you can just share it to Plaid. Usually this means giving them your bank login information and providing the permissions for them to download data such as financial account details:

- Account numbers

- Account names

- Account balances (credit, checking, loan, savings, etc.)

- Personal information (name, address, email, phone)

Plaid ensures that only the financial data requested by the apps is shared, maintaining a high level of privacy and security.

The company will then protect and manage your information by (supposedly) only giving out what is necessary to the apps who request it.

Is Plaid Safe To Use?

This question can’t be answered by a simple yes or no. But considering that the company has not been hacked and there isn’t any kind of Plaid security breach so far, I’d have to say that…

Yes, Plaid is safe. For now.

I have to point out though that the company has recently settled a privacy lawsuit over the alleged collection of more information than what was needed. While San Francisco-based Plaid did not admit to any wrongdoing, they did agree to delete some data, minimize new data, and give user more data control.

Creating a Plaid Portal account allows you to manage and view the financial data you have shared, enhancing transparency and control over your information.

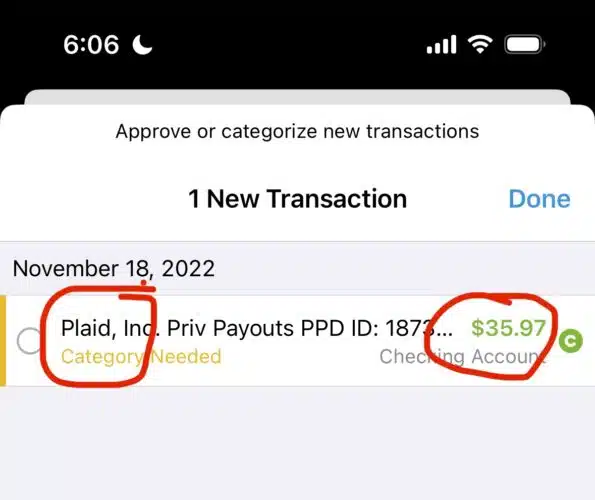

For those who did apply for a claim on the settlement, the payout for individuals was less than amazing.

Clearly, the justice system values our privacy.

How Plaid Handles Financial Data

Plaid takes the security of your financial data very seriously. When you connect your bank account to Plaid, the company employs advanced encryption protocols, such as the Advanced Encryption Standard (AES 256) and Transport Layer Security (TLS), to safeguard your data during transmission. This means that your financial information is encrypted and protected from unauthorized access while it travels between your bank and the financial apps you use.

In addition to encryption, Plaid uses multi-factor authentication (MFA) to add an extra layer of security. This ensures that only you can authorize the connection of your financial accounts, making it much harder for anyone else to gain access.

Plaid acts as an intermediary between your financial information and the financial sites you want to share your data with. This setup means you only share the specific information you choose, and the financial sites do not have access to all your banking data. For example, if you only want to share your account balance, Plaid ensures that only this piece of information is transmitted.

Your financial data is stored in a secure environment, with strict access controls in place. Plaid’s employees and contractors are bound by confidentiality agreements and can only access your data on a need-to-know basis.

Moreover, Plaid provides you with control over your financial data through the Plaid Portal. In the Plaid Portal, you can view and manage your connected accounts, and you have the option to disconnect any account at any time. This gives you the flexibility to maintain your financial data private and secure, without having to access the individual financial apps.

What are the Alternatives to Plaid?

Unfortunately, there aren’t very many alternatives to using Plaid. Often, you’re stuck with whatever service the app or account you’re using allows you to use. If that’s only Plaid…that’s all you can use.

There are, however, some other options which aren’t nearly as convenient. This includes:

- Manually link your bank account. Manually linking bank accounts, including your savings account, is often possible and requires much less information than what Plaid retrieves. It’s usually not immediate, however.

- Use a different payment method. This allows users to have more control on their data.

Should YOU use Plaid for Bank Account?

Here’s the reality: PLAID equals convenience, NO PLAID equals inconvenience. If you read any other Plaid reviews, that’s basically what you’ll see.

In fact, there are certain apps that won’t automatically pull your transactions unless you’re using Plaid to share your bank account information.

In the end, it all comes down to the decision that YOU have to make between privacy and convenience and the balance between the two.

If you’re interested to learn more about the latest online privacy tips, make sure to read the secret truths VPNs don’t want you to know.

Be sure to subscribe to the All Things Secured YouTube channel!