You’ve probably seen the advertisement about home title fraud and asked yourself: “How common is home title theft anyway?” The truth isn’t as dire as these insurance companies want you to believe, but the risk does exist. If you want a better explanation backed by actual FBI data, read on.

When selling insurance – or any kind of protective service – fear is the most common marketing strategy. Title lock companies know that the only way you’ll spend money protecting your title is when they can get you afraid that might actually lose it.

But is that really true?

To answer that question, it’s good to first understand what is home title theft, and then look closely at the numbers.

What is Home Title Theft?

Home title theft, also known as deed theft or title fraud, is a type of real estate fraud where a criminal uses forged documents to transfer someone’s property deed into their name.

This gives the scammer the ability to sell the property to an unsuspecting third party and pocket the profits. While home title theft is relatively uncommon (see below for details), it can have severe consequences for homeowners. Victims may face significant financial loss, damage to their credit score, and even the risk of foreclosure.

Understanding what home title theft entails is the first step – and arguably most important step – in protecting yourself from this insidious crime.

The Risks of Home Title Theft

Home title theft poses significant risks to homeowners, including:

- Financial Loss: Scammers can sell the property and pocket the profits, leaving the homeowner with substantial financial losses.

- Damage to Credit Score: Home title theft can result in negative marks on the homeowner’s credit report, damaging their credit score and making it harder to obtain credit in the future.

- Foreclosure: If the scammer fails to make mortgage payments, the property can go into foreclosure, leaving the homeowner with a damaged credit score and financial losses.

- Identity Theft: Home title theft often involves identity theft, where a fraudster uses a homeowner’s personal details to falsify identifying documents.

These risks highlight the importance of being vigilant and taking steps to protect your home title.

How Home Title Theft Happens

Home title theft typically involves the following steps:

- Identity Theft: A fraudster obtains a homeowner’s personal details, such as their name, address, and social security number, through various means, including social media, the dark web, and phishing scams.

- Forged Documents: The fraudster uses the stolen identity to create forged documents, such as a deed or title, that appear to transfer ownership of the property to the scammer.

- Filing with the County: The scammer files the forged documents with the county recorder’s office, making it appear as though they are the rightful owner of the property.

- Selling the Property: The scammer sells the property to an unsuspecting third party, pocketing the profits and leaving the homeowner with significant financial losses.

Understanding these steps can help you recognize and prevent potential home title theft.

Putting Home Title Fraud in Perspective

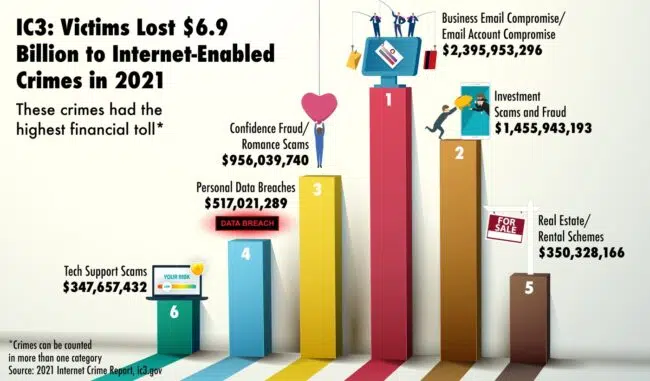

In the most recent FBI Internet Crime Report, which categorized different kinds of internet fraud, real estate and rental schemes made the list, but it wasn’t nearly as high as other risks people face such as confidence fraud, email compromise, investment scams and data breaches. House stealing, a type of home title theft that combines identity theft and mortgage fraud, is one example of real estate fraud.

But when you see $350 MILLION as the price tag for real estate fraud, you can’t ignore that.

But there are two important details to consider within this number:

- Home Title Fraud is only one kind of real estate fraud: The numbers that the FBI reports include so many different kinds of real estate fraud and home title scams are a tiny percentage of that.

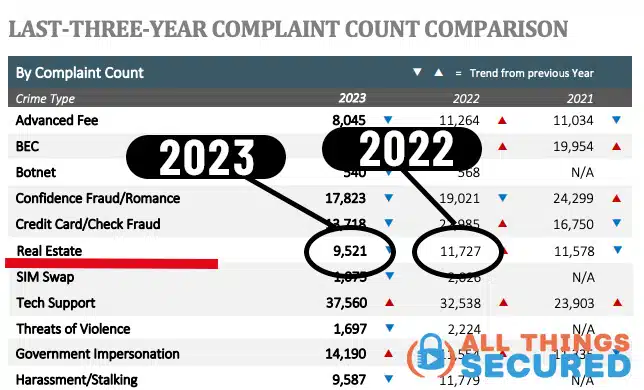

- Home Title Fraud is DOWN year over year: As you can see in the graphic below, the number of home title fraud cases has gone down by almost 20% year over year.

Does home title fraud exist? Absolutely, it does.

But are you at high risk? Absolutely not.

Home title theft is not very common.

Home Title theft is not very common in the US, nor around the world, and it continues to decrease every year. This is not because insurance exists, but rather because banks, realtors and other entities are becoming wise to this scam and easily preventing it before it starts.

So is something like home title lock necessary? Honestly, don’t feel like you need to go out and purchase unnecessary home title insurance. The chances are extremely low that you will be a victim, and if you’re still worried you can always ask to put an email alert with your local county to let you know of any fishy changes to title documents.

Protecting Yourself from Home Title Theft

To protect yourself from home title theft, it’s essential to take the following steps:

- Monitor Your Credit Report Regularly: Check your credit report regularly to detect any suspicious activity or errors.

- Keep Your Personal Information Secure: Be cautious when sharing your personal information online and avoid using public computers or public Wi-Fi to access sensitive information.

- Use Strong Passwords: Use strong, unique passwords for all online accounts, and consider using a password manager to keep track of them.

- Monitor County Records: You have the option to set up an alert with your county for any changes to your title. This will allow you to see anything suspicious before it becomes a huge problem. This, more than title insurance, is an effective way to protect yourself.

- Be Aware of Home Title Theft Scams: Be cautious of unsolicited offers to purchase title insurance or other services that claim to protect you against home title theft.

Honestly, title insurance is one of the last things I recommend when it comes to protecting against title defects. It’s the least effective and most expensive option. By following these steps, you can significantly reduce your risk of falling victim to home title theft.

Trends in Home Title Theft

Home title theft is a growing concern, with the FBI reporting consistent numbers in real estate and rental schemes over the year years. However, the incidence of home title theft is still relatively low, and most homeowners are not at high risk.

To stay ahead of the scammers, it’s essential to stay informed about the latest trends and tactics used by home title thieves. Some of the latest trends include:

- Increased Use of Technology: Scammers are using technology to create sophisticated forged documents and to target homeowners through online phishing scams.

- Targeting Vulnerable Homeowners: Scammers are targeting vulnerable homeowners, such as seniors and those with significant equity in their homes.

- Using Social Media: Scammers are using social media to obtain personal information and to target homeowners.

By staying informed and taking steps to protect yourself, you can reduce your risk of falling victim to home title theft.