Home title theft is a real problem and the idea of someone stealing the title of your home is horrifying. But before you start to worry too much, make sure you understand all the details. Is it a common threat? Do you need to purchase insurance? How do you prevent home title theft? Here is everything you need to know.

In order to give you the best understanding of home title theft, we’re going to cover five of the most common questions that people have on the topic:

- What is Home Title Theft?

- What are the signs of home title theft?

- Who is at risk for title fraud scams?

- How do I prevent home title theft?

- Is Home Title Lock a waste of money? (this is an insurance company)

Let’s dive into each of these questions individually.

What is Home Title Theft?

Home title theft, also known as title fraud, is when criminals change the ownership of your property without you knowing it. It’s a new type of identity theft that involves forged and fraudulent documents.

You might be surprised to learn that your house title isn’t an actual document. Your deed is a legal document, but a title is defined as “the legal right to ownership of a property, including the right to sell it”.

This is why you’ll hear the terms “home title theft” and “home deed theft” used synonymously.

Whenever you bought your house, the title company does extensive due diligence to make sure that the seller actually has the ownership right to sell the home and that there aren’t any other legal claims on the property. Mortgage lenders, title companies and even real estate firms have so many different checks and balances in place to make sure that when a house is bought or sold, there isn’t any kind of fraud involved, because a lot of times they would be on the hook for it, not you.

Home Title Theft is ILLEGAL

It’s important to understand this very basic principle: when any kind of title fraud happens, it’s not legal. It is a crime.

When any kind of home title fraud happens, it is not legal.

Somebody tried to steal actress Halle Berry’s house in Los Angeles a few years ago and guess what? He was arrested and charged with forging a fraudulent document. End of story.

So if somebody randomly shows up at your door one day claiming to have purchased your house, rest assured that if you never signed the document, then the new deed is, in fact, fraudulent. A bank can’t come after you for fraudulent borrowing…that’s on them.

What are the Signs of Home Title Theft?

There are only a few signs of home title theft that you should be aware of.

- Notice of Unpaid Bills: If you start receiving bills at the house you occupy (or a rental that you own), this might be a sign of home title theft. This could be a utility bill, tax bill, or a mortgage bill that either you don’t recognize or have already paid.

- Missing Bills: If you notice that you stopped receiving a utility bill or that you’re missing a tax bill that you were expecting, this should also put you on alert for potential home title theft.

- Notice of Foreclosure: If you’ve either paid off your home or pay your mortgage regularly, any type of foreclosure notice should set off alarm bells for you (obviously).

- Signs of Life: If you have a home that you don’t live in (a rental, vacation home or just a vacant property), if you see evidence of somebody starting to live there, you could either have a problem with squatters or…you could be the victim of home title theft.

Here’s the reality, though: home title fraud is not a very common type of fraud. In fact, according to the FBI, it’s one of the least common scams out there.

So if it’s not that common, it’s helpful to understand who has the highest risk of being defrauded.

Who is Most at Risk for Title Fraud?

While home title theft does happen, the odds are very low that it will happen to you. It helps, however, to understand which types of people are at risk.

Keep in mind, even when we say “at risk”, if you fall into one or all of these three categories, you’re still at a very, very low risk. Regardless, you should pay special attention to home title fraud if you fall into the following categories:

- People whose homes are paid off: Have you paid off your mortgage? The fact that you no longer have a bank keeping watch over your title puts you at slightly higher risk.

- People whose homes are unoccupied or not monitored: If the house you own is empty, there’s a higher risk of this kind of fraud. Consider installing cameras in the house or driving by every so often.

- The elderly: As is the case for most kinds of scams, the people who are least likely to know how to protect themselves are also the ones who are most targeted.

So what can you do to protect yourself?

How to Prevent Home Title Theft

Home title insurance companies and title lock insurance would like you to believe that the only thing you can do to prevent home title theft is to purchase their product. But that isn’t true.

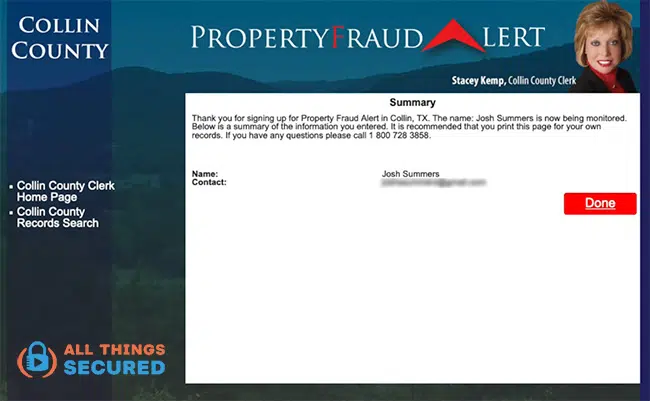

One of the easiest steps you can take to protect yourself against home title theft is to set a title notification or alert with your local government county property ownership records. It might look like this:

These alerts from the county recorder’s office are free and can usually be found by searching for “[name of your county] + title notification or title alert” and you’ll usually find what you’re looking for. You’ll be asked to enter your name, the address of your property and the email address where notifications need to be sent.

That’s it!

While it doesn’t prevent home title theft (neither does a title insurance company), it does give you immediate notification so you can rectify the situation.

Speaking of home title insurance…

Is Home Title Lock a Waste of Money?

Is a home title lock necessary?

In short…not really.

It’s not a “scam” per se, but it is entirely unnecessary. Even many of the home title lock reviews seem fishy. Title insurance simply monitors your title activity and provides alerts in case sudden changes have occurred. In other words, it will only alert you after changes have occurred, so it does not prevent it.

Home Title Lock does not prevent theft. It simply alerts you of it.

As mentioned earlier, you can get this same kind of title monitoring service from you local county government, so essentially all you’re paying for with Home Title Lock is insurance protection against losses.

Unfortunately, if you read the fine print, they don’t cover legal fees or representation, so you’ll have to pay that on your own.

Watch the Video!

Learn more about home title fraud in this video produced by All Things Secured:

Be sure to subscribe to the All Things Secured YouTube channel!